Welcome to Lowe Levinson Financial Solutions

At Lowe Levinson Financial Solutions, we understand that managing your finances can be complex and overwhelming. With over 35 years of experience in accounting, tax preparation, and credit repair, we are dedicated to providing our clients with the expertise and personalized service they deserve.

Our mission is to empower individuals and businesses to achieve financial success through comprehensive solutions tailored to your unique needs.

Schedule a Consultation

Get a Refund Advance Up to $5000 in Minutes!

Easy – Pre-Qualify Online! Refund Advance in Minutes.

Explore our range of services and discover how we can help you navigate the financial landscape with confidence. At Lowe Levinson Financial Solutions, your success is our priority.

Pre-Qualify Now

Our Services

Accounting Software Selection & Implementation

Selecting the right accounting software is crucial for effective financial management. Our experts will help you choose the best software tailored to your business needs and oversee the implementation process to ensure a seamless transition.

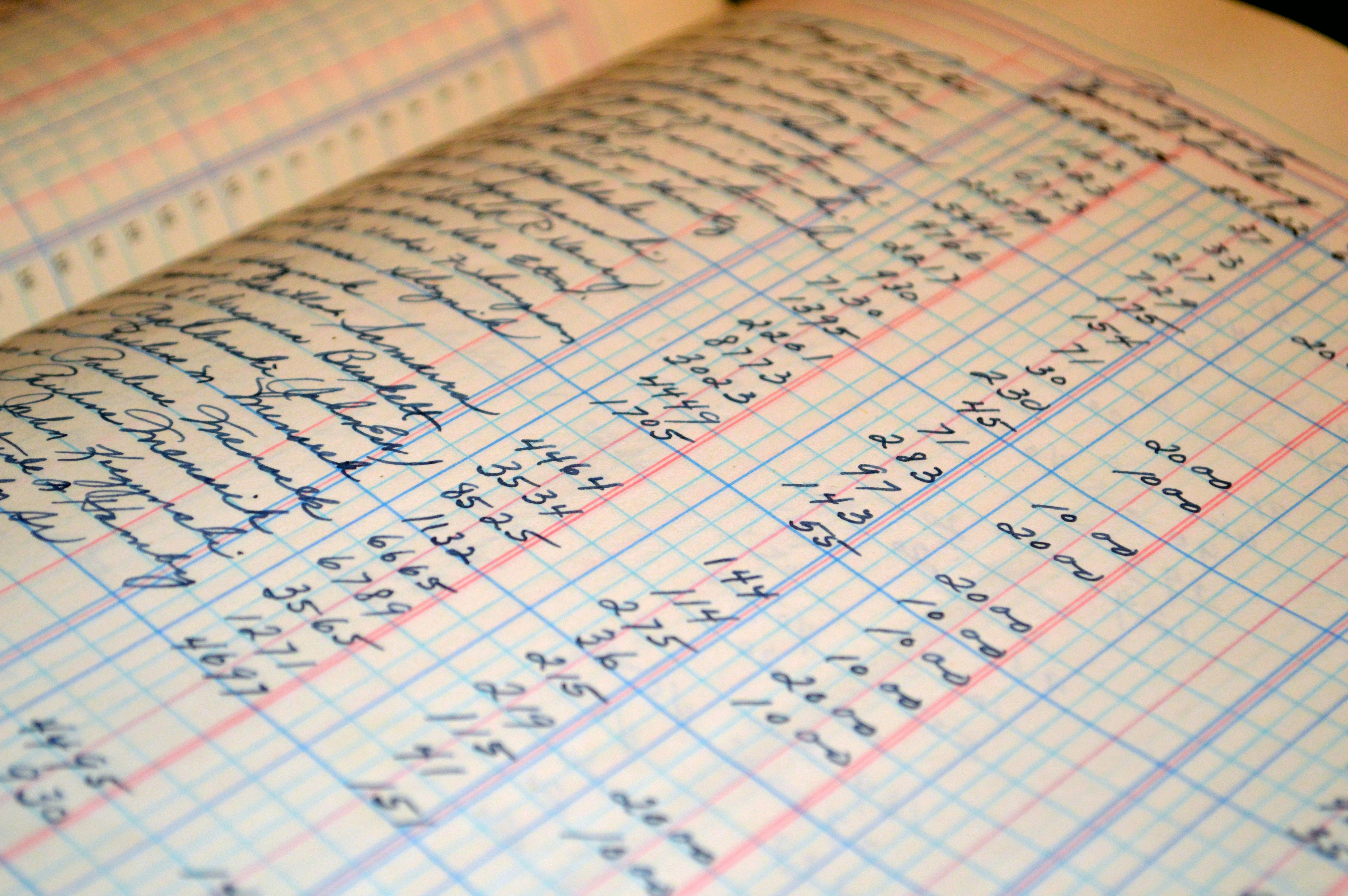

Bookkeeping/Write-Up

Accurate bookkeeping is the backbone of any successful business. Our team provides comprehensive bookkeeping services, including transaction recording, reconciliations, and regular write-ups, allowing you to focus on what you do best.

Business Consulting

Navigating the complexities of running a business can be challenging. Our business consulting services offer strategic insights and advice to help you make informed decisions, improve operations, and drive growth.

Business Entity Selection

Choosing the right business entity is vital for legal and tax purposes. We guide you through the options—whether it’s a sole proprietorship, partnership, LLC, or corporation—ensuring that you select the structure that best suits your goals.

Credit Repair

A strong credit profile is essential for personal and business success. Our credit repair services help identify and dispute inaccuracies on your credit report, providing you with the support needed to improve your credit score and financial health.

Estate & Trust Tax Preparation

Planning for the future is important. We specialize in estate and trust tax preparation, ensuring that all filings are accurate and compliant with tax regulations, while maximizing potential tax benefits for you and your beneficiaries.

Financial Statements

Clear and concise financial statements are essential for informed decision-making. We prepare and analyze financial statements, providing you with insights into your business's performance and financial health.

IRS Representation

Dealing with the IRS can be stressful. Our experienced team provides IRS representation, handling audits, appeals, and any correspondence on your behalf to resolve issues efficiently and effectively.

Notary Public

Our certified notary public services ensure that your important documents are executed correctly and legally. We provide convenient notary services to meet your personal and business needs.

Payroll Services

Managing payroll can be time-consuming and complex. We offer comprehensive payroll services, including processing, tax filings, and compliance, allowing you to focus on running your business smoothly.

Retirement Planning

Planning for retirement is essential for financial security. Our retirement planning services help you develop a strategy that aligns with your goals, ensuring you have the resources you need for a comfortable retirement.

Sales Tax Services

Navigating sales tax regulations can be challenging. We provide sales tax services, including registration, filing, and compliance, to help your business stay on track and avoid penalties.

Tax Preparation & Planning

Our tax preparation and planning services ensure that you are compliant with tax laws while maximizing deductions and credits. We work closely with you to develop a tax strategy that minimizes liabilities and supports your financial goals.

How We Work

Step 1: Organize Your Financial Records

Gather Documentation: Collect all relevant financial documents, including income statements, receipts, invoices, and bank statements.

Categorize Expenses: Organize your expenses into categories (e.g., utilities, travel, supplies) to make tracking easier.

Use Accounting Software: Consider using software like QuickBooks or Xero to help digitize and manage your records efficiently.

Step 2: Understand Your Tax Obligations

Identify Tax Types: Understand the types of taxes applicable to your situation (e.g., income tax, sales tax, payroll tax).

Know Deadlines: Be aware of tax deadlines to avoid penalties, including estimated tax payments and filing dates.

Stay Informed: Keep up with any changes in tax laws that might affect your business or personal finances.

Step 3: Prepare Financial Statements

Create Basic Statements: Prepare key financial statements such as the Income Statement, Balance Sheet, and Cash Flow Statement.

Analyze Performance: Review these statements to assess business performance and identify areas for improvement.

Consult a Professional: If needed, consider consulting a CPA or tax advisor to ensure accuracy and compliance.

Step 4: File Taxes & Monitor Financial Health

File Timely: Complete and file your tax returns on time, ensuring all deductions and credits are claimed.

Set Up a Payment Plan if Needed: If taxes are owed and immediate payment isn’t feasible, consider setting up a payment plan with your tax authority.

Regularly Review Finances: Monitor your financial health throughout the year, adjusting budgets and forecasts to stay on track.