Tax Tools

- Home

- Tax Tools

Who is required to file?

The income tax code is ever-changing, and keeping up can be quite a daunting task. Lowe Levinson tax preparation pros use three key tax rules to determine if you are required to file a personal tax return. By using our tax preparation services, you’ll be able to simplify and speed up your tax filing process. Let’s go through the tax basics and updates.

First, let’s look at the three key factors that determine whether or not you are required to file a tax return.

| Filing Status | Age | Income |

|---|---|---|

| Single | Under 65 Blind/65 or Older | $14,600 $16,550* |

| Head of Household | Under 65 Blind/65 or Older | $21,900 $23,850 |

| Married, Filing Jointly | Under 65 (both spouses) Blind/65 or Older (one spouse) Blind/65 or Older (both spouses) | $29,200 $30,750** $32,300** |

| Married, Filing Separately | Any Age | $5 |

| Qualifying Widow(er) | Under 65 | $29,200 |

| With Dependent Child | Blind/65 or Older | $30,750** |

| Self-Employed | Any Age | $400 |

| Filing Status | Amount |

|---|---|

| Single | $14,600 |

| Head of Household | $21,900 |

| Married, Filing Jointly | Qualifying Widow(er) | $29,200 |

| Married, Filing Separately | $14,600 |

| Dependent Standard Deduction (range) | $1,300 – $14,600 |

Personal Exemptions were were eliminated in 2018.

If your gross income is above a certain amont you are requirews to file a federal tax return. Depending on your filing status, your age, and type of income you’re reporting, your gross income includes all income that you recieve in the form of money, goods, property, and services.

If you are 65 or older or legally blind any age on the last day of the tax year, you are allowed a higher amount of gross income that other tax payers before you are required to file a return. By visiting calling us, you can learn more about the different examptions based on the age bracket you fall under.

Figuring out your filing status is the first step in determining your filing requirement and your standard deduction. There are distinct differences in the filing status. Skilled teams of tax preparation professionals are ready to help you understand the subtleties.

| Umarried Filers | Married Filers | Rate | ||

|---|---|---|---|---|

| Over | But Not Over | Over | But Not Over | 2024 |

| $0 | $11,600 | $0 | $23,200 | 10.0% |

| $11,600 | $47,150 | $23,200 | $94,300 | 12.0% |

| $47,150 | $100,525 | $94,300 | $201,050 | 22.0% |

| $100,525 | $191,950 | $201,050 | $383,900 | 24.0% |

| $191,950 | $243,725 | $383,900 | $487,450 | 32.0% |

| $243,725 | 609,350 | $487,450 | $731,200 | 35.0% |

| $609,350 | or more | $731,200 | or more | 37.0% |

Tax rate schedules help you estimate your federal income tax. The tax tables are based on your expected filing status.

The actual amount of your income tax is figured on Form 1040, 1040A, or 1040EZ

| Filing Status | Income Range | Tax Rate (2024) |

|---|---|---|

| Unmarried | $0 – $11,600 | 10% |

| Married | $0 – $23,200 | 10% |

| Unmarried | $11,600 – $47,150 | 12% |

| Married | $23,200 – $94,300 | 12% |

| Unmarried | $47,150 – $100,525 | 22% |

| Married | $94,300 – $201,050 | 22% |

| Unmarried | $100,525 – $191,950 | 24% |

| Married | $201,050 – $383,900 | 24% |

| Unmarried | $191,950 – $243,725 | 32% |

| Married | $383,900 – $487,450 | 32% |

| Unmarried | $243,725 – $609,350 | 35% |

| Married | $487,450 – $731,200 | 35% |

| Unmarried | $609,350+ | 37% |

| Married | $731,200+ | 37% |

What is EITC, Earned Income Tax Credit

The EITC is the most popular refundable tax credit. EITC or simply EIC, Earned Income Credit, is designed to help working families who have low to moderate income. A “refundable” tax credit means you may be eligible to receive a refund. If there’s a tax liability, the credit is used to reduce the amount of tax you owe. In cases where there is zero tax due, the credit becomes fully refundable.

Whether you worked Full-Time, Part-Time or simply did odd jobs on the side, if you have earned income it may be worth filing your taxes. Approximately 20% of the taxpayers who are eligible for EIC do not actually claim the credit. Even if you aren’t required to file, the Earned Income Credit could mean more money in your pocket!

You work hard all year – let our Tax Pros work for you & get you maximum refund!

Want to find out if you qualify for the Earned Income Credit? Use our easy EIC Calculator. Follow the easy steps below and answer all questions…

How does the Child Tax Credit work?

The Child Tax Credit (CTC) is a non-refundable tax credit for each qualifying child you carry on your federal tax return.

The credit is worth up to $2,000 per child but is limited to the amount of tax you owe on your return. The remainder amount cannot be taken as a refund. However, if you are unable to take the full Child Tax Credit because your tax liability is less than the amount of the CTC, you may qualify for the Additional Child Tax Credit – which is fully refundable (up to $1700 per/child).

What’s more, starting in 2018, you could receive a personal tax credit of up to $500 for other qualified dependents in your household.You have enough on your plate with juggling home, work and caring for your children – sit down with one of our Tax Pros and you’ll be glad you did! Our Tax Preparation Experts are IRS certified and go through a rigorous training process to insure accuracy, satisfaction and maximum refund – guaranteed!

Use our easy CTCalculator to find out if you qualify to claim the Child Tax Credit on your tax return.

Tips for Maximizing Benefits of Child Tax Credit

Take Advantage of the Full Credit Amount

You can claim a tax credit of up to $2,000 for each qualified child. Make sure to apply for it to get the maximum benefit. You can claim the credit for every child dependent under the age of 16 in your household.

Go for the Additional Child Tax Credit

If you have no tax liability due, you maybe be able to receive up to $1,700 of the refundable credit. However, the rules for claiming the credit are a bit complex. No need to worry; we’ll guide you through the whole process.

Apply for Child and Dependent Care Credit

If you’re paying for childcare while you are at work, claim the child and dependent care credit. This credit allows you to deduct up to $3,000 in expenses for a single child and up $6,000 for two or more. Don’t miss out on the opportunity to reduce your tax burden.

Ensure your Records Are Accurate

Make sure use keep accurate records of all you child care expenses. This will ensure a stress and hassle-free process.

Why Choose Lowe Levinson?

Tax Preparation Experts

For over 15 years, Lowe Levinson Financial Solutions has been guiding individuals with their tax returns and credits. Just know we’re certified experts when it comes to taxes.

Your Tax Squad Tailored to You

Lowe Levinson Financial Solutions is your partner in all things tax. Whether you’re aiming for a tax refund advance or applying for a child tax credit, we’ll help you where you need it.

Rock-Solid Reputation

We’ve been in the tax business for over 15 years, and our tax experts have a combine 30 years of tax industry knowledge with them.

Refund Assurance

Your tax refund is in safe hands. We’re here to make sure you get Maximum Refund Guaranteed!

What are Education Tax Credits and Deductions?

The IRS allows eligible students to claim one the following education credits or deductions on their tax return:

Tax credits include: The American Opportunity Tax Credit (AOC), which is a refundable credit, is for undergraduate students who are working towards a degree. The Lifetime Learning Credit, however, is non-refundable and either undergraduate or graduate students may be eligible. Both are a dollar-for-dollar reduction of the taxes you owe on your return but the AOC is fully refundable if you have zero tax due.

Tax deductions include: The Tuition and Fees Deduction is for students who paid tuition and other fees required to enroll at an eligible intuition. The other deduction, Student Loan Interest Deduction, is allowed for any interest paid on student loans. Both reduce your taxable income and help offset any taxes you might owe.

You’ve made the right choice by investing in your or your child’s future! Let Lowe Levinson Pros guide you through the steps of which credit or deduction is best for you.

Use our easy Educalculator to find which credits and/or deductions you qualify to claim on your tax return…

Education Credit You Can Qualify For:

There are two types of education credits you can apply:

> American Opportunity Tax Credit (AOTC)

> Lifetime Learning Credit (LLC)

Third Party entity that has paid the qualified educational expenses for either you or the student you claimed as a dependent. Payments by third parties include amounts paid by relatives or friends.

Credits & Deductions Checklist

This checklist will help you determine if you qualify for the child tax credit:

Age

A child must have been under age 17 (age 16 or younger) at the end of the year

Dependent

You must claim the child as a dependent on your federal tax return.

Relationship

A child must either be your son, daughter, stepchild, foster child, brother, stepbrother, or a descendent of any of these individuals, which includes your grandchild, niece, or nephew.

Citizenship

The child must ba a U.S. citizen, U.S. national, or U.S. resident alien

Support

The child must not have provided more than half of his/her. own support.

Residence

The child must have lived with you for more than half the tax year.

Limitations

The credit is now refundable up to $1,700 limited if you modified adjusted gross income is above a certain amount. The amount varies depending on your filling status.

$400k

Married Filling Joint

$200k

For all other taxpayers

Tax Deductions & Credits

For Taxpayers with children

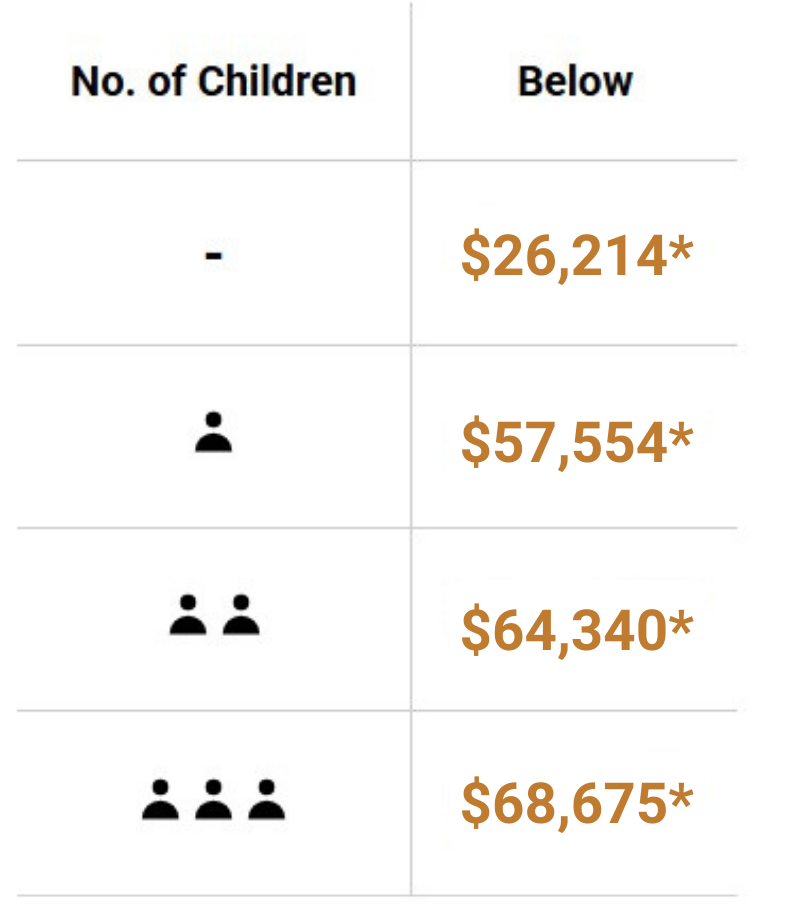

Earned Income Tax Credit

Income Threshold

AGI earned income

*Max income for Married Filing Jointly

Dependent Age Test

UNDER 19

Note: Any age if dependent is disabled

Child & Dependent Care Tax Credit

For 1 Child

Up to $3,000 in child care expenses

For more than 1 qualifying child

Up to $6,000 in child care expenses

Limitations of Credit

The credit will be reduced when AGI reaches $125,000. An eligible family with an AGI of $125,000 or less will get a credit worth 50% of their qualifying expenses. The credit further reduces from 50% to 20% for families with an AGI between $125,001 and $183,001. Credit will stay at 20% for families with an AGI from $183,001 to $400,000, but will continue to reduce again from 20% to 0% for families with an AGI above $400,000. If your AGI is above $438,000, the credit is completely phased out.

Lifetime Learning Credit

Max Credit

20%

of tuition and fees for any post-secondary education; maximum of $2,500 for the household.

Income Threshold

For individual taxpayers, the American Opportunity Credit phases out if modified adjusted gross income is over $69,000. For married filing joint, the credit phases out if MAGI is over $138,000.

Student Age Limit

NONE

Note: If student is dependent of another, taxpayer may claim credit.

American Opportunity Tax Credit

Max Credit

UP TO $2500

per student for four years of post-secondary education

Income Threshold

For individual taxpayers, the American Opportunity Credit phases out if modified adjusted gross income is over $90,000. For married filing joint, the credit phases out if MAGI is over $180,000.

Student Age Limit

NONE

Must be taxpayer’s dependent.

The credit is 40% refundable, up to $1,000, so it can benefit even those with no tax liability

Additional Child Tax Credit

This year credit is partial refundable up to $1700 in Additional Child Tax Credit, but you first must qualify for the Child Tax Credit. If the amount of your Child Tax Credit is not limited by your income tax liability, you may be able to claim the Additional Child Tax Credit.

$400k

Married Filling Joint

$200k

Single, head of household, or qualifying widow(er)

For each $1,000 by which the taxpayer’s adjusted gross income (AGI) exceeds $75,000 ($150,000 for joint fliers), the child tax credit is reduced by $50.The Additional Child Tax Credit is fully refundable less any tax liability. Tax-exempt combat pay counts as earned income for calculating the Additional Child Tax Credit.

There are many types of deductions in the tax code. Generally speaking, there are two types of deductions the IRS allows: one can elect to take the flat standard deduction – which is based on your filing status – or elect to take itemized deductions. While both allow you to lower your taxable income, it can be a bit of a challenge determining which method works best for your personal tax situation. Lowe Levinson Financial Solutions preparation experts can help you navigate around the complexities and guide you towards the deduction that is most beneficial and suits your tax profile best.

Taxpayers are categorized into a tax bucket based on their filing status.

A standard deduction is the dollar amount that can be deducted from one’s income. Your standard deduction is determined based on your filing status. In some cases, the standard deduction may exceed itemized deductions.

The standard deduction for the 2025 tax year

| Status | Deduction | 65 Years or Olders (additional) | Blind (additional) |

|---|---|---|---|

| Single | $15,750 | $6,000* | $2,000 |

| Married Filing Jointly | $31,500 | $12,000* | $1,600 |

| Married Filing Separately | $15,750 | $1,600 | $1,600 |

| Head Of Household | $23,625 | $2,000 | $2,000 |

| Qualified Widow(er) With Dependent Child | $16,000 | $1,600 | $1,600 |

*(MAGI) phase-out limits: above $75,000 for single filers and $150,000 for joint filers.

Itemized deductions allow you to deduct your expenses such as mortgage, interest, donations, medical expenses, and so forth. When the total of your itemized deduction exceeds your standard deduction, your total deduction amount begins to increase. Additional deductions can reduce the amount of income being taxed and increase your tax refund or diminish any tax liability. Take advantage of our accurate tax preparation services at Lowe Levinson. With superior understanding of the tax codes as well as state and federal deductions, our team of tax service professionals will assess your personal tax situation and help you find and claim all the credits and hidden tax deductions you qualify for and one’s that benefit you most from one’s income. Your standard deduction is determined based on your filing status. These amounts are governed by the IRS.

Itemized Deductions

In general, if your total itemized deductions exceed the standard deduction, you should itemize. This includes these situations:

- You do not qualify for the standard deduction, or the amount of the standard deduction is limited

- You pay interest and taxes on a home or personal property

- You have large, uninsured casualty or theft losses

- You have large, uninsured medical and dental expenses

- You have large, unreimbursed employee business expenses

- You make large contributions to qualified charities

Most deductions are subject to the 2% of adjusted gross income (AGI) rule. This means the sum of expenditures greater than 2% of your total AGI are deductible in the amount that exceeds the 2%. If you’re under 65, medical and dental expenses that are greater than 10% of your total AGI are deductible in the amount that exceeds the 10%. If either you or your spouse is 65 or older, you can deduct the amount that exceeds 7.5% of your AGI. The limitation for itemized deductions claimed on tax returns for tax year 2016 will begin with incomes of $259,400+ (Single), $285,350+ (Head of Household) and $311,300+ (married couples filing jointly).

Casualty and Theft Losses

Casualty and theft losses are the unexpected loss of property. Casualty and theft losses are deductible as an itemized deduction. A casualty occurs when your property is damaged as the result of an identifiable event that is sudden, unexpected, and unusual.

- A sudden event is swift, not gradual or progressive.

- An unexpected event is unanticipated and unintended.

- An unusual event is not a normal day-to-day occurrence and is not typical of the types of activities in which you engage

Amount of Loss To determine the amount of loss, you must know the fair market value (FMV) of the property before and after the loss and your adjusted basis in the property. Fair market value can be determined by the amount for which you could sell the property in its present condition. Adjusted basis is usually what the item cost, increased or decreased by events such as improvements, deterioration, or depreciation.

The amount of the loss is the lesser of the decrease in FMV as the result of the casualty or your adjusted basis in the property before the casualty or theft.

You must reduce the amount of loss by any reimbursement you receive, or expect to receive. Reimbursements include insurance recovery.

Once the amount of loss is determined, the loss must be further reduced by $100 if the property is personal. The $100 reduction for personal property applies to each casualty or theft during the year, regardless of how many items are involved in each incident.

After the $100 reduction, you must further reduce the amount of loss by 10% of your adjusted gross income (AGI). The balance remaining after these two reductions is the deductible amount of your loss.

Victims of Ponzi Schemes

The deduction amount is equal up to 95% of the taxpayer’s lost investment, or 75% if the taxpayer is seeking recovery. The amount of the deduction is reduced by any withdrawals the taxpayer received from the investment, and by any recovered amounts.

If the loss was considered a capital loss, taxpayers are limited to offsets up to their capital gains losses; an additional $3,000 is allowed as a deduction against ordinary income. The excess loss can be carried forward indefinitely but is insignificant for many investors who were victims of large fraud schemes.

As a result, the IRS announced in 2009 that investors can take an ordinary loss deduction for Ponzi-type losses that isn’t subject to the 2% of adjusted gross income (AGI) limit on miscellaneous itemized deductions, the income-based limitation on itemized deductions, or the 10% of AGI limitation on the deduction for casualty losses.

Special rules may apply to theft losses from Ponzi-type investment schemes. For more information, see the Form 4684 (PDF) and the Form 4684 Instructions (PDF), Casualties and Thefts. Additionally, review Help for Victims of Ponzi Investment Schemes. (source: https://www.irs.gov/taxtopics/tc515.html)

Charitable Contributions

Charitable contributions are donations made to qualified charitable organizations. The contributions can be monetary, or physical property.

50% of AGI Limitations

Organizations qualifying for the 50% limit include churches, educational organizations that maintain a regular student body and staff, and organizations that provide medical research, education, or care.

30% of AGI Limitations

Organizations qualifying for the 30% limit include qualified organizations considered private organizations.

20% of AGI Limitations

Capital gain properties donated to private organizations qualify for the lesser of 20% of your AGI or 30% of your AGI minus any 30% limitation contributions made

Contribution Limitations The overall limitation of charitable contributions is 50% of your adjusted gross income (AGI). If your contributions exceed this limit in a given tax year, you can deduct the remainder of your contributions over the next 5 tax years.

Deductible Taxes

If you itemize deductions, you may be able to deduct the following taxes:

- State, local and foreign income taxes

- State and local personal property taxes.

- State and local sales taxes(instead of your State & Local personal property taxes. But not both.)

Employee Business Expenses

If you itemize deductions and are an employee, you may be able to deduct certain work-related expenses.

Only employee business expenses that are in excess of 2% of your adjusted gross income (AGI) can be deducted.

Qualifying Business Expenses

Expenses that qualify for an itemized deduction include:

- Business travel expenses

- Business use of car

- Business entertainment expenses

- Business use of your home

- Work-related educational expenses

- Miscellaneous employee expenses

Medical and Dental Expenses

If you itemize deductions and you’re under 65, you may deduct the amounts you paid for medical and dental expenses that exceeds 10% of your adjusted gross income (AGI). If either you or your spouse is 65 or older, you can deduct the amount that exceeds 7.5% of your AGI.The deduction is allowed for expenses paid for the prevention and alleviation of a physical or mental defect or illness. Medical expenses include expenses related to diagnosis, cure, mitigation, treatment, or prevention of disease, or treatment affecting any function or structure of the body.

Deduction Guidelines

- Expenses must be for you, your spouse or your dependent, or for anyone who would qualify as your dependent except for having a gross income of more than $4,050.

- Expenses must be paid during the current tax year, regardless of when incurred.

- Expenses must not be compensated by insurance.

- Expenses must not be paid out of a tax-free medical savings or health savings account.

- You must subtract from your deduction total any reimbursement of medical expenses, whether they were paid to you or directly to the doctor or hospital.

Mortgage Points

Home mortgage points are certain charges you pay to obtain a home mortgage.

Deduction Guidelines

All of the following conditions must be met for your home mortgage points to be fully deductible in the year you paid them:

- Your main home must secure your loan.

- Paying points must be an established practice in your area.

- The points you paid were not more than what is generally paid for points in your area.

- You use the cash method of accounting; that is, you report income and deductions in the year they occurred.

- The points were not paid for items generally separated on the settlement sheet.

- You must have paid the points at or before closing with funds not from your lender or mortgage broker.

- You must have obtained a loan to buy or build your main home.

- The points were computed as a percentage of the mortgage principal.

Tests for Qualifying Child

Relationship

A qualifying child is a child who is your

Son

Brother

Daughter

Sister

Stepchild

Stepchild

Foster Child

Step brother/sister

A descendent

Age

A qualifying child is a child who was

Under Age 19

at the end of current tax year and younger than you (or your spouse, if filing jointly)

Under Age 24

at the end of current tax year a student and younger than you (or your spouse, if filing jointly)

Any Age

permanently and totally disabled at any time during the year

Joint Return

A qualifying child is a child

who is not filing a joint return for current tax year (or is filing a joint return for current tax year only to claim a refund of income tax withheld or estimated tax paid).

Residency

A qualifying child is a child

who lived with you in the United States for more than half of the current tax year.

You can’t claim the EIC for a child who didn’t live with you for more than half of the year, even if you paid most of the child’s living expenses. The IRS may ask you for documents to show you lived with each qualifying child. Documents you might want to keep for this purpose include school and child care records and other records that show your child’s address.

If the child didn’t live with you for more than half of the year because of a temporary absence, birth, death, or kidnapping, see Temporary absences, Birth or death of child, or Kidnapped child in this chapter.

Affordable Care Act (ACA)

Affordable Care Act (ACA) – Lowe Levinson Financial Solutions can help you retrieve & file Form 1095-A

EasyMoney Loan

Get Refund Advance up to $5000 No Credit Check. High Approvals.